How to get Australian Stock Market Index Analysis

The Australian stock market, primarily represented by the Australian Securities Exchange (ASX), is a significant financial marketplace where a wide range of securities, including stocks, bonds, derivatives, and other financial instruments, are traded. Here’s a detailed overview of the Australian stock market:

Overview

- Name: Australian Securities Exchange (ASX)

- Type: Stock Exchange

- Country: Australia

- Established: The ASX was formed in 1987 through the merger of several regional stock exchanges. It was previously known as the Sydney Stock Exchange and other regional exchanges.

Key Indices

- S&P/ASX 200: The most prominent index on the ASX, representing the 200 largest companies by market capitalization listed on the exchange. It is widely used as a benchmark for the Australian stock market.

- S&P/ASX 50: Includes the 50 largest companies listed on the ASX, providing a broader view of the largest players in the market.

- S&P/ASX 300: Tracks the performance of the top 300 companies on the ASX, including those in the S&P/ASX 200 and smaller stocks.

- S&P/ASX All Ordinaries: Includes all the stocks listed on the ASX, providing a comprehensive view of the market.

Constituents

- Major Companies: The ASX features a diverse range of companies across various sectors, including financial services, mining, energy, healthcare, and technology.

- Sector Representation: The ASX is known for its strong representation in sectors like mining and resources due to Australia’s rich natural resources. Financial services and healthcare are also significant sectors.

Market Segments

- Equities: The primary segment where stocks and shares of listed companies are traded.

- Fixed Income: Bonds and other debt securities are traded, providing investment opportunities in government and corporate bonds.

- Derivatives: Futures and options are available for trading, including products based on stock indices, commodities, and interest rates.

- Exchange-Traded Funds (ETFs): A variety of ETFs track different indices, sectors, and asset classes, offering investors diversified exposure.

Trading Hours

- Regular Trading: The ASX operates from 10:00 AM to 4:00 PM Australian Eastern Standard Time (AEST), with a pre-open session starting at 7:00 AM.

- After-Hours Trading: Limited after-hours trading is available, but most trading activity occurs during regular market hours.

Regulation and Governance

- Regulator: The Australian Securities and Investments Commission (ASIC) regulates the ASX and oversees market activities to ensure transparency, fairness, and compliance with financial laws.

- Clearing and Settlement: The ASX Clearing Corporation and ASX Settlement operate the clearing and settlement of trades, ensuring efficient and secure processing of transactions.

Recent Developments

- Technological Advancements: The ASX has been adopting new technologies, including blockchain and digital ledger systems, to enhance trading efficiency and security.

- Market Trends: The Australian stock market has seen significant changes in sectoral representation, with increased focus on technology and renewable energy in recent years.

Investment Products

- ETFs and Mutual Funds: Numerous ETFs and mutual funds are available, providing exposure to various sectors and asset classes.

- Derivatives: Futures, options, and other derivatives are used for hedging and speculative purposes.

Notable Companies

- Commonwealth Bank of Australia (CBA): One of Australia’s largest banks and a significant player in the financial sector.

- BHP Group: A leading global resources company, heavily involved in mining and natural resources.

- Woolworths Group: A major retailer operating supermarkets, liquor stores, and other retail businesses.

- CSL Limited: A global biotechnology company specializing in immunology and other health-related areas.

Analyzing Australian stock market indices, such as the S&P/ASX 200 (ASX 200), using Python involves collecting historical price data, performing data analysis, and creating visualizations to gain insights into the performance of the Australian stock market. Here's a step-by-step guide on how to conduct Australian stock market index analysis in Python:

Import Libraries:

Start by importing the necessary Python libraries for data manipulation, analysis, and visualization. Commonly used libraries include pandas, numpy, matplotlib, and yfinance to fetch historical data:

Python

Copy code

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import yfinance as yf

Data Retrieval:

Use the yfinance library or other financial data sources to fetch historical data for the ASX 200 or other Australian indices. Specify the start and end dates for the data you want to analyze:

Python

Copy code

asx200 = yf.download('^AXJO', start='2020-01-01', end='2021-12-31')

Data Exploration:

Explore the fetched data to understand its structure and contents. Use functions like head(), tail(), describe(), and info() to inspect the dataset:

Python

Copy code

print(asx200.head())

Data Visualization:

Create visualizations to analyze the historical performance of the ASX 200 or other Australian indices. Common visualizations include line charts to visualize index price movements:

Python

Copy code

plt.figure(figsize=(12, 6))

plt.plot(asx200['Adj Close'], label='ASX 200')

plt.title('ASX 200 Index Price')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend()

plt.show()

Technical Analysis (Optional):

Perform technical analysis by calculating and visualizing technical indicators like moving averages, relative strength index (RSI), and MACD. You can use libraries like ta-lib for these calculations.

Statistical Analysis (Optional):

Conduct statistical analysis to calculate summary statistics, volatility measures, and correlations with other assets. You can use Numpy and Pandas for these calculations.

Sentiment Analysis (Optional):

Consider incorporating sentiment analysis of news articles or social media data related to the Australian stock market to understand market sentiment's impact on the ASX 200.

Fundamental Analysis (Optional):

Analyze fundamental factors affecting the Australian economy, such as GDP growth, inflation rates, and interest rates, which can influence the ASX 200's performance.

Prediction and Forecasting (Optional):

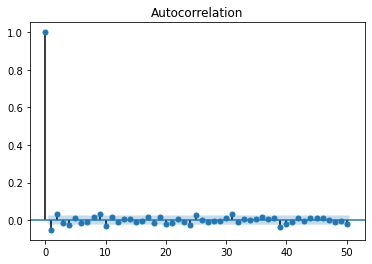

You can use time series forecasting techniques like ARIMA or machine learning models to make predictions about future ASX 200 movements.

Risk Management and Decision Making:

Based on your analysis, formulate investment strategies, set risk management parameters, and make informed investment decisions regarding the ASX 200 or Australian stocks.

Regular Updates:

Keep your analysis up to date with the latest data to adapt to changing market conditions and make timely decisions.

Remember that investing in stock markets carries risks, and it's crucial to do thorough research, consider economic and geopolitical factors, and potentially consult with financial experts before making investment decisions based on your analysis of the ASX 200 or any other stock index.

Forecast in python

df = yf.download('^AXJO',

start='1985-01-01',

end='2021-08-12',

progress=False)

df = df.loc[:, ['Adj Close']]

df.rename(columns={'Adj Close':'adj_close'}, inplace=True)

df['simple_rtn'] = df.adj_close.pct_change()

df['log_rtn'] = np.log(df.adj_close/df.adj_close.shift(1))

df[['simple_rtn','log_rtn']].tail(20)

AXJO realized_volatility

def realized_volatility(x):

return np.sqrt(np.sum(x**2))

df_rv = df.groupby(pd.Grouper(freq='M')).apply(realized_volatility)

df_rv.rename(columns={'log_rtn': 'rv'}, inplace=True)

df_rv.rv = df_rv.rv * np.sqrt(12)

fig, ax = plt.subplots(2, 1, sharex=True)

ax[0].plot(df)

ax[1].plot(df_rv)

0 Comments