NASDAQ Composite Price Analysis

The NASDAQ Composite is a major stock market index that tracks the performance of all the companies listed on the NASDAQ stock exchange. It is known for its focus on technology and growth-oriented companies. Here’s a detailed overview:

Index Overview

- Name: NASDAQ Composite

- Type: Stock Market Index

- Country: United States

- Exchange: NASDAQ Stock Market

- Established: 1971

Constituents

- Broad Representation: The NASDAQ Composite includes over 3,000 companies, making it one of the broadest indices in terms of the number of constituents.

- Focus: It has a significant emphasis on technology and internet-based companies, but it also includes firms from sectors such as healthcare, consumer services, and finance.

Calculation Method

- Market Capitalization-Weighted: The NASDAQ Composite is a market capitalization-weighted index, meaning that the larger the company’s market capitalization, the greater its influence on the index’s performance.

- Free-Float Adjusted: The index uses free-float market capitalization, which reflects only the shares available for public trading, excluding those held by insiders and strategic holders.

Purpose and Use

- Benchmark: It serves as a key benchmark for the performance of the NASDAQ stock exchange and is widely used to gauge the overall performance of technology and growth stocks.

- Investment: The index is a popular gauge for investors who are interested in technology and innovation. It provides insights into the performance of many high-growth companies.

Historical Performance

- 1971: The NASDAQ Composite was launched on February 5, 1971, with a base value of 100 points.

- Growth: Over the decades, the index has grown significantly, particularly as technology companies have become more prominent in the stock market.

Significance

- Technology and Innovation: The NASDAQ Composite is often associated with high-growth technology companies. It includes major tech giants such as Apple, Microsoft, Amazon, and Alphabet (Google’s parent company).

- Market Sentiment: It reflects market sentiment toward technology and innovation, often serving as an indicator of investor confidence in these sectors.

Recent Developments

- Dot-Com Bubble: The NASDAQ Composite experienced a dramatic rise during the late 1990s dot-com bubble and a significant crash in 2000. It has since recovered and continues to be a major index.

- Growth Trends: In recent years, the index has benefited from the strong performance of tech stocks and companies involved in digital transformation, e-commerce, and biotechnology.

Investment Products

- ETFs and Mutual Funds: Many financial products are designed to track the NASDAQ Composite, including ETFs (such as QQQ, which tracks the NASDAQ-100, a related index) and mutual funds.

- Derivatives: Futures and options based on the NASDAQ Composite are available, providing investors with tools for hedging and speculation.

Notable Companies

- Tech Giants: The index includes many influential technology companies like Apple, Amazon, Facebook (Meta Platforms), and Microsoft.

- Diverse Sectors: In addition to tech, it includes companies from other sectors such as healthcare, consumer goods, and finance.

Data Retrieval:

Start by obtaining historical NASDAQ Composite Index data. You can use financial data providers or APIs to fetch this data. Alternatively, some Python libraries like yfinance or alpha_vantage may provide access to index data. For example, with yfinance:

Python

Copy code

import yfinance as yf

nasdaq_data = yf.download('^IXIC', start='2020-01-01', end='2021-12-31')

Data Exploration:

Explore the retrieved data to understand its structure and characteristics. Use Pandas to inspect the dataset with functions like head(), tail(), describe(), and info().

Python

Copy code

print(nasdaq_data.head())

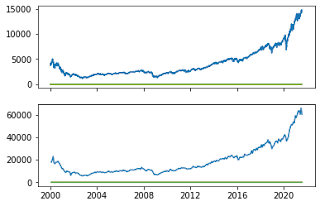

Data Visualization:

Create visualizations to gain insights into the NASDAQ Composite Index's historical performance. Common visualization types include line charts, candlestick charts, and bar charts.

Python

Copy code

import matplotlib.pyplot as plt

plt.figure(figsize=(12, 6))

plt.plot(nasdaq_data['Close'], label='NASDAQ Composite')

plt.title('NASDAQ Composite Index Price')

plt.xlabel('Date')

plt.ylabel('Index Value')

plt.legend()

plt.show()

Trend Analysis:

Analyze trends by calculating and plotting moving averages. Common moving averages include the 50-day and 200-day moving averages. Crossovers of these averages can signal potential changes in the trend.

Python

Copy code

# Calculate moving averages

nasdaq_data['MA_50'] = nasdaq_data['Close'].rolling(window=50).mean()

nasdaq_data['MA_200'] = nasdaq_data['Close'].rolling(window=200).mean()

# Plot moving averages

plt.figure(figsize=(12, 6))

plt.plot(nasdaq_data['Close'], label='NASDAQ Composite')

plt.plot(nasdaq_data['MA_50'], label='50-Day MA')

plt.plot(nasdaq_data['MA_200'], label='200-Day MA')

plt.title('NASDAQ Composite Index Price with Moving Averages')

plt.xlabel('Date')

plt.ylabel('Index Value')

plt.legend()

plt.show()

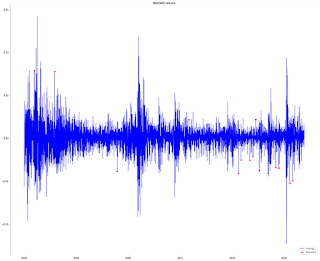

Volatility Analysis:

Assess the index's volatility using statistical measures like standard deviation, historical volatility, or Bollinger Bands. Volatility analysis can help in risk assessment.

Sentiment Analysis (Optional):

Consider incorporating sentiment analysis of news, social media, or market reports related to the technology sector, as the NASDAQ Composite primarily consists of tech stocks.

Fundamental Analysis (Optional):

Investigate fundamental factors such as earnings reports, economic indicators, and interest rates, which can influence the NASDAQ Composite.

Market Events Analysis:

Identify and analyze significant market events or news releases that had a substantial impact on the NASDAQ Composite Index.

Prediction and Forecasting (Optional):

You can use time series forecasting techniques, such as ARIMA or Prophet, to make predictions about future NASDAQ Composite Index movements.

Risk Management and Decision Making:

Based on your analysis, formulate investment strategies, set risk management parameters, and make informed investment decisions regarding the NASDAQ Composite Index or individual tech stocks.

Regular Updates:

Keep your analysis up to date with the latest data to adapt to changing market conditions and make timely decisions.

Remember that investing in the stock market carries risks, and it's crucial to conduct thorough research and potentially consult with financial professionals before making any investment decisions based on your analysis of the NASDAQ Composite Index.

Ghost effect/feature fig;

What is NASDAQ Composite?

The NASDAQ Composite (ticker symbol ^IXIC) is a stock market index that includes almost more than 2500 stocks

How to get NASDAQ data from yahoo finance?

! pip install yfinance

df = yf.download('^IXIC', IXIC-NASDAQ

start='2000-01-01',

end='2021-07-27',

progress=False)

df.tail()

How to get a simple and log return of NASDAQ?.

| simple_rtn | log_rtn | |

|---|---|---|

| Date | ||

| 2021-06-28 | 0.009757 | 0.009710 |

| 2021-06-29 | 0.001919 | 0.001917 |

| 2021-06-30 | -0.001678 | -0.001680 |

| 2021-07-01 | 0.001271 | 0.001270 |

| 2021-07-02 | 0.008053 | 0.008021 |

| 2021-07-06 | 0.001661 | 0.001659 |

| 2021-07-07 | 0.000097 | 0.000097 |

| 2021-07-08 | -0.007179 | -0.007205 |

| 2021-07-09 | 0.009762 | 0.009715 |

| 2021-07-12 | 0.002130 | 0.002128 |

| 2021-07-13 | -0.003773 | -0.003780 |

| 2021-07-14 | -0.002228 | -0.002230 |

| 2021-07-15 | -0.006953 | -0.006977 |

| 2021-07-16 | -0.007969 | -0.008001 |

| 2021-07-19 | -0.010554 | -0.010610 |

| 2021-07-20 | 0.015685 | 0.015563 |

| 2021-07-21 | 0.009178 | 0.009136 |

| 2021-07-22 | 0.003598 | 0.003592 |

| 2021-07-23 | 0.010378 | 0.010324 |

| 2021-07-26 | 0.000251 | 0.000251 |

Calculate the monthly realized volatility NASDAQ * **

Annualize the values NASDAD:

0 Comments